Can Packaging Corp of America Continue to Outperform in 2018

svetikd/E+ via Getty Images

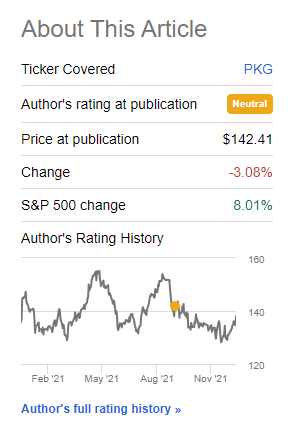

Being a company in the manufacturing of Packaging is a good thing at this time. Packaging Corporation of America (NYSE:PKG) is certainly no exception to this. The issue with the company has always been price. It's often at a premium that really isn't sustainable. That's why I went firmly "HOLD" in my last article.

Since that article, the company has gone nowhere, making this the right choice.

(Source: Seeking Alpha Article)

Some investments I've made since that time have gained around 15-18% RoR, with triple-digit annualized RoR's. Valuation is important, and it's why I went "HOLD" back then.

In this article, we update our thesis.

(Source: Packaging Corporation of America)

How has the company been doing?

It didn't take a crystal ball to expect the overall development here once COVID-19 really got its teeth into the economy. As a business that's focused on packaging and carton, the company had its work cut out for it, with large expected increases following the pandemic. The company is realizing these growth expectations and is on track to exceed box shipments in double digits on a YoY basis.

(Source: Seeking Alpha PKG Article)

I stand by this stance for the company. The fundamental appeal of the business has never been the issue - the valuation has.

However, with 3Q21, we do have some new facts that needed consideration in the valuation model for the company - and these have not only changed the forecasts slightly but also changed how well the company has been doing.

PKG beat expectations by $0.35 on an EPS basis, as well as a revenue beat of $70M.

Why? A few reasons.

- Favorable price and mix

- Higher production volume as well as price/mix in paper

- Lower non-operating pension expense

- Lower interest expenses due to refinancing and lower cost of debt

So, favorable trends that drive margins and earnings higher - or at least they would do so significantly if it weren't for OpEx increases. PKG is certainly not immune to increases in inflation and operating costs. In fact, looking at the cash impact, this is probably one of the companies with higher impacts I've reviewed.

Input cost increases flowed from:

- Labor/Benefits

- Feedstock pricing (fiber)

- Energy pricing

- Repairs and maintenance pricing

- Supply pricing increases

Aside from these, there are also well-covered headwinds in logistics, with costs significantly higher due to fuel prices, staff shortages, truck supply, and a higher spot pricing mix for logistics.

A very problematic mix and situation not only for PKG but for many companies, forcing the businesses to keep very good track of expense/income dynamics to maintain not only high profit but high margins.

So far, PKG has done that. Company EBITDA margins were up by 400 bps on a YoY basis, and none of the headwinds has in any way impacted the high packaging demand we've been seeing since the onset of the pandemic.

The company is responding to current issues by capacity changes, using its Alabama mill to produce containerboard to meet demand due to high demand but also outages in other mills.

At the same time, it's clear that the situation out there currently can be very difficult.

With no relief from the supply chain obstacles that we, our customers and our suppliers continue to face, along with unprecedented inflation-related challenges, the combination of all of these efforts are critical to our success going forward.

(Source: PKG Earnings Call Transcript, 3Q21)

Focus for the company, aside from maintaining its numbers, is the utilization of its assets to properly reflect the current demands of its markets. The current focus is the mill in Alabama, with its machines being repurposed to handle containerboard as opposed to uncoated freesheet.

PKG does still have a customer base for legacy freesheet paper, and for the time being, that customer base is being served by one mill, able to produce all freesheet grades, with the addition of one machine at the Alabama mill when needed.

Company results were good - but the company sees a significant impact from current headwinds. Fundamentals remain strong, with the cost of debt down and interest expenses down. The company saw significant sales and gross profit increases, and almost a 100% increase in YoY pre-tax income as well as net income. Long-term debt has remained flat and total long-term liabilities are down slightly for the company.

The company remains investment-grade with a market cap north of $12 billion, and the current yield, higher than when I last wrote on PKG, is almost at that 3% level. For my cost basis, the yield is 3%.

Many investors and some contributors went bullish too early on PKG. This is a volatile business, and the only way to go about this one, in my view, is to wait for those massive dips. When they arrive - you buy. However, dips need to be seen in a broader context than what they fell from and a short-term historical perspective.

We need longer views and forecasts.

What is the valuation?

I am unwilling at this time to consider any significant premium valuation to the company. Buying PKG at a high premium has always been a good way to get your negative returns handed to you, so to speak.

This company does tend toward volatility, and the recent year is no exception.

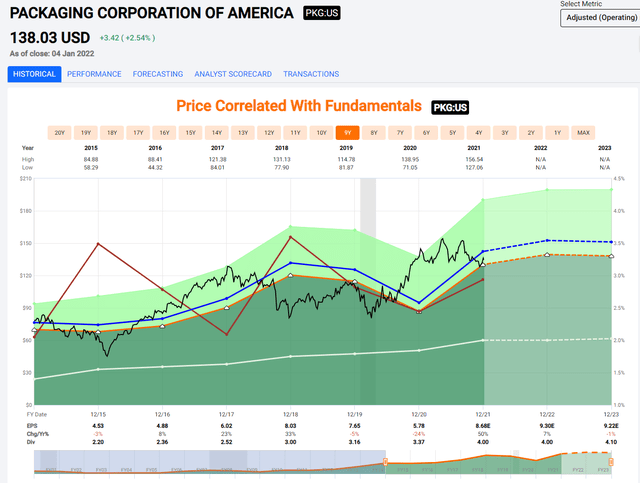

(Source: F.A.S.T Graphs)

What we're seeing is essentially a recovery to pretty standard result levels following a poor 2020. Future visibility is poor. Current expectations dictate that the company remain more or less flat in terms of EPS, but these forecasts have a high 40%+ miss ratio even with a 10% margin of error (Source: FactSet).

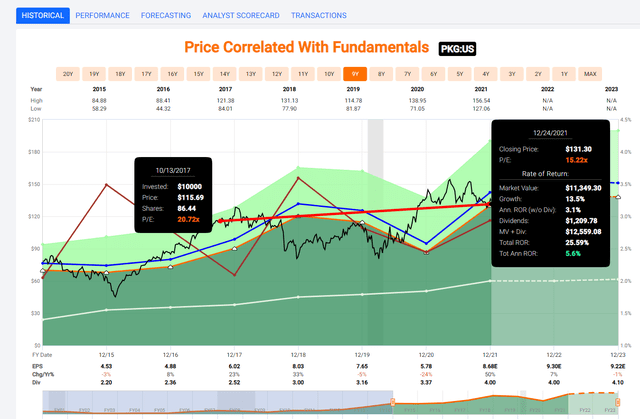

What I will say is that with the exception of 2018-2019, a valuation of around 15X has always been a good price to pick up PKG. On a 9-10 year basis, if bought at such multiples, PKG has managed annualized, market-beating returns of 12.3%. If you bought it when "everyone" was exuberant, well, your returns would have been less than average market returns.

(Source: F.A.S.T Graphs)

Timing isn't so much a thing - but being aware of valuation certainly is.

That's why I'm saying, at this time, that it's time to start considering PKG somewhat differently. PKG has the very clear potential to trade at ranges of 16-18X P/E at extended periods of time. While a drop-down to record low-P/Es would result in clear, negative rates of return here, I don't view this as likely in the near term.

Why do I not view this as likely?

There are no current catalysts for it. Global demand for containerboard and packaging is at record levels. The economies are strong. At this point, it seems very unlikely we'll see demand compression going forward - that would require recessionary trends.

To me, this means that PKG's biggest current risks are its input costs/profit margin ratios and balances. To date, PKG has managed these well through capital allocation, capacity refocusing, refinancing, and price/mix. In terms of containerboard, it's a seller's market, so even some of the headwinds we're seeing aren't really likely to give PKG pause - for now.

A 15-18X forward P/E ratio for 2023E gives us a very real possibility of generating 4.0-12.5% annualized RoR at a fairly attractive yield. Even at conservative ratios and multiples, I see this company becoming more and more attractive the closer to that sub-$130/share level it goes.

Current average analyst targets give the company an upside of about 3.4%, based on an overall target price of $142/share. While I don't necessarily disagree with this, I would not pay a price for PKG at this time that has a $14X number - I want at least below $140/share, and preferably as close to/ below $130/share.

The reason for that is that based on current estimates, results, and historicals as well as valuation models, that's where the minimum "sweet spot" is. Anything below that, and we're talking clear undervaluation. Anything far above that, and it gets less appealing.

At current levels, PKG showcases its slight premium to public comps with a slightly higher EV/EBITDA as well as revenue multiple. International Paper (IP) is cheaper here and carries what I believe to be a significantly better upside to fair value. For me, this would be another to consider.

However, viewed in a vacuum, PKG is starting to get appealing here. I bought slightly more, and the more towards $130/share it drops, the more interesting it gets.

At current levels and with current global forecasts, I'm going to a "BUY" here - albeit with a slight valuation upside, and a 4-12% annualized RoR until 2023 depending on where things go.

Thesis

My regular readers know that this segment is one of my wheelhouses. I invest not only in PKG and IP but in European peers including but not limited to SCA (OTCPK:SVCBF), Essity (OTCPK:ESSYY), Stora Enso (OTCPK:SEOJF), UPM-Kymmene (OTCQX:UPMKY), and I keep informed of companies I don't yet invest in, including Klabin (OTCPK:KLBAY), Avery Dennison (AVY), WestRock (WRK). It's not just containerboard - it's pulp, toilet paper, and all manner of paper products.

It's something we will always need, as I see it. That makes the entire sector appealing.

My thesis for Packaging Corporation of America is:

- A great business with great fundamentals, and a good market share of NA containerboard. Should be considered attractive at the right valuation, and management is proactively managing the current inflation/logistical/cost headwinds to stay ahead of the curve and improve margins.

- PKG is a "BUY" here. A price target that I would consider attractive for investment based on my goals would be around $130-139/share - though every investor of course needs to look at their own targets, goals, and strategies. I would also always consult with a finance professional before making investment decisions such as this.

- I consider it not unlikely that PKG could deliver annualized RoR of around 4-13% until 2023.

Remember, I'm all about:

1. Buying undervalued - even if that undervaluation is slight, and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn't go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years - and that is all I intend to continue doing (even if I don't expect the same rates of return for the next few years).

If you're interested in significantly higher returns, then I'm probably not for you. If you're interested in 10% yields, I'm not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Packaging Corporation of America is currently in a position where #1 is possible in my process, through #3 and #4.

Thank you for reading.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

Source: https://seekingalpha.com/article/4478044-packaging-corporation-america-no-longer-return-sender-pkg